Frequently Asked Question

Bartercard operates as a ‘trade exchange’ and has transformed traditional bartering into a modern business tool and many people search for bartarcard faqs. Using online technology, Bartercard has created a flexible, secure and fully accountable way for businesses to trade their goods and services with businesses world-wide.

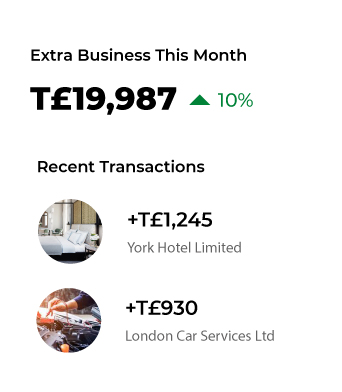

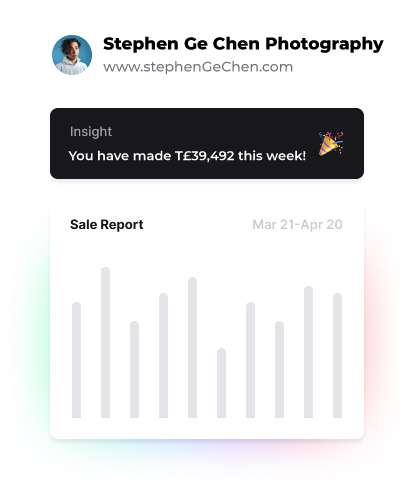

Bartercard facilitates and monitors the purchases (debits) and sales (credits) undertaken by members. These transactions are recorded electronically and its members receive a monthly statement that summarises their transactions. Members can transact using the following: phone application with transactional capabilities and online transactional options. In addition, Bartercard promotes member businesses and maintains and updates a member business directory.

The vision of Bartercard is to be the leading global marketplace where businesses connect and trade their goods and services.

Bartercard currently operates in ten countries.

Bartercard can work for any company that has the capacity to take on additional business. There are many case studies and trading tips available for members to study to see how Bartercard can work for them.

Bartercard has approximately 55,000 cardholders who are trading over T£425 million a year.

There are over 650 categories of business, everything from Accommodation to Zoos.

Bartercard welcomes many industries and businesses.

You can sell almost anything through Bartercard. Besides your own products and services there is nothing stopping you from selling something from home or even buying from a manufacturer or wholesaler at cost and then on-sell through Bartercard. Your trading is only limited to the efforts you are willing to put in to be successful

There are many different ways to use Bartercard to build your business and improve your lifestyle. Upon joining you will have access to many video tutorials and case studies on unique and creative ways to solve common business challenges. A dedicated Account Specialist will also be available for you to discuss the many options that best suit your business and lifestyle needs. You can get a sense of how some of members use Bartercard by clicking on ‘Testimonials’.

A Bartercard transaction is similar to a credit/debit card transaction.

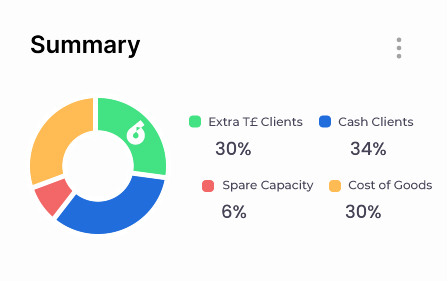

Members earn trade pounds for goods and services they sell and this value is recorded electronically in the member’s account. Members use their Bartercard transactional card to spend their credit balance (or draw on their interest-free line of credit) on goods and/or services from any other Bartercard member. The flexibility of the Bartercard system is you don’t have to purchase from the same business that purchases from you; you can spend locally, nationally and internationally; you can sell now and buy later; you can use the interest free trade pound credit lines provided and buy first before even making a sale.

Yes, your business pays for your personal expenses so if you can save cash on expenses then it just makes sense to use Bartercard.

You can pay trade pounds as a director’s dividends, drawings or loan. As a tip there is no Benefit Tax applicable if you deposit cash into your business and draw out the equivalent amount of trade pounds in exchange. There is further explanation of this on how to incorporate trade pounds into your payroll system in our creative business tips available for members. However, we always suggest members speak to their accountant regarding how best to implement these strategies into their business.

Yes, you can limit the amount of trading you do. We suggest Bartercard members trade up to 10% to 15% of their total business turnover. We understand there are times when you may be operating at full capacity for a period or seasonally at your peak. Working with your Account Specialist you’ll work out a plan for the amount of trading that best suits you and your business. You can start slowly and as you work with us to bring on more suppliers of your choice you can increase the amount of trade you do.

When you join, a comprehensive business analysis is conducted with the view to identify potential suppliers already available in our network. If there are insufficient suppliers available to suit your business requirements then Bartercard will work with you to bring on additional new suppliers to satisfy your needs. Many of Bartercard’s top trading members have successfully improved their business profitability by being proactive in their recommendation and referral of new suppliers to provide them with the products and services they need to run a successful business.